Portfolio Monitoring

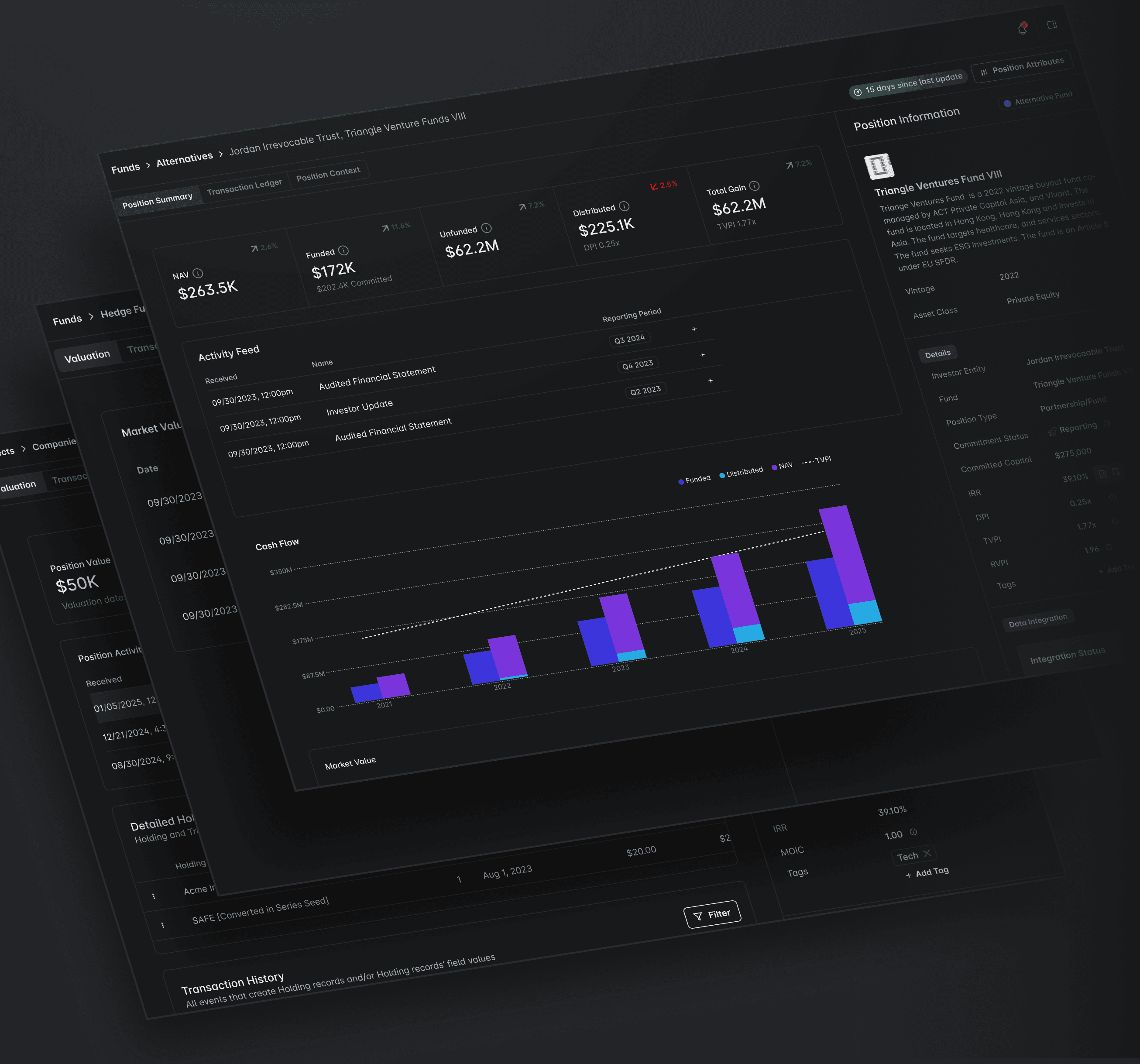

Real-time valuation and performance reporting for alternative investments — consolidated, validated, and automated.

For every dollar of alpha generated, a significant portion is consumed by operational overhead. This hidden tax grows with portfolio size and complexity, creating a paradoxical reality: the difference between mediocre and exceptional performance may have less to do with investment strategy and more to do with how efficiently you manage the administrative burden.

Track every private market asset with streaming real-time updates, zero manual effort.

Portfolio Monitoring

Portfolio Intelligence, Perfected

Sophisticated institutions don't wait weeks for statements to be processed manually. Neither should you.

Workbook

Automated Assurance for

Complex Fund Reporting

Alternative funds generate a torrent of reporting statements wrapped in unique formatting and arcane accounting. Deciphering these statements drains expertise and causes constant doubt over the accuracy of your reporting. Workbook is powered by our patented ingestion and validation engine, delivering ironclad proof of accuracy so you can trust your reporting without reservation